RETIREMENT PLANNER

VERSION 2a - Form Entry

This is the detail version of Retirement Planner with all the features of the Direct Entry version but with a more accurate year by year drawdown. Entry are broken down into section where the user is prompted for each entry and the results are only shown on the summary page.

Below are previews of the entry forms and summary page. For detail explanations of each section please refer to the Direct Entry form page.

ASSETS

This is an overview of your ASSETS Section and where you enter and track your RRSP, RRIF and HOME accounts and set the withdrawal amounts to satisfy your financial needs during retirement.

BUDGET TEMPLATES

There are four Budget templates available covering the four potential housing conditions that may occur during your retirement. They are HOME (house), RENT, CONDO and RESIDENCE (retirement home).

You should fill in the estimated budget amounts for all the applicable categories at present day $ value. The Planner will adjust the budget amounts based on the inflation rate you've set to the FUTURE value at your retirement age. If you've already calculated your monthly budget elsewhere, simply enter the overidding monthly amount at the top of each budget. You can also use the overriding feature to cut back in case you find that your assets do not meet your retirement planning.

The inflated amounts for the corresponding budget will be used to compare against your selected withdrawal amounts for the housing stages during your retirement. This will guide you to withdraw more, or less to meed you needs for each year of retirement.

FEDERAL AND PROVINCIAL TAX

Detail Federal and Provincial tax are calculated for each and every year of your retirement. While the intention is to be as precise as possible, certain aspects not representing significant amounts may have been ignored.

There are no user input required on these tabs.

Step 1 - Personal Information form

Step 2 - Government and Company Pensions form

Step 3 - Inflation Alowance, Tax adjustments and Additional Income form

Step 4 - Assets form

Step 6 - Drawdown Stage 1

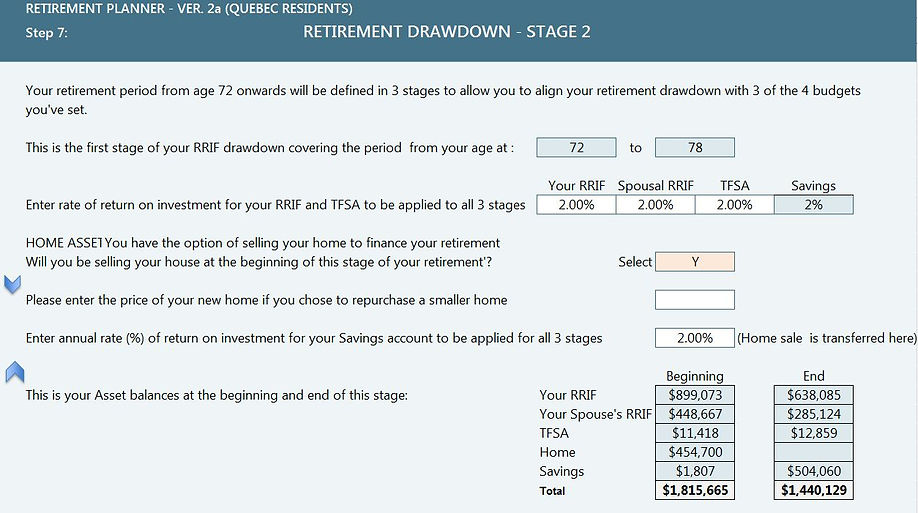

Step 7 - Drawdown Stage 2

Step 8 - Drawdown Stage 3

Step 9 Drawdown Stage 4

Step 5 - Budget form

Budget Templates

Summary