BASIC PLANNER

VERSION 1 - Direct Entry

A simplified version of the Retirement Planner but with all the details that counts. Entry and results are all on the a single Excel form for easy reference between input and results.

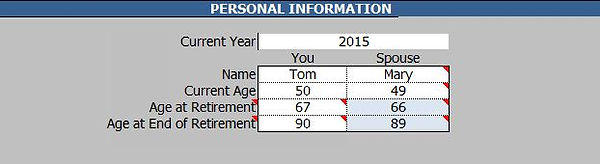

PERSONAL INFORMATION

This is where you enter your personal information - name, current age, age at retirement and age at end of retirement and that of your spouse (leave blank and clear all spousal entries if you are single)

This information wil be used to calculate your savings and retirement period as well as pro-rating all amounts (withdrawal, pension and tax) to the inflation you set to reflect as close as possible the actual amounts in the future when you retire.

GOV'T PENSIONS & INFLATION ALLOWANCE

Set the age you plan to claim your QPP or CPP pension by selecting from the dropdown list, as well as your estimated pension amount if you are not expecting the receive the maximum amount. This wil be used to calculate the QPP amount you will receive.

Set inflation adjustment rates for your withdrawals from RRSP and Home (saving) accounts and government pension amounts. You must also enter an estimate of the yearly increased amount for your Federal and Provincial Basic Personal Exemption.

ASSETS

This is an overview of your ASSETS Section and where you enter and track your RRSP, RRIF and HOME accounts and set the withdrawal amounts to satisfy your financial needs during retirement.

ASSETS - RRSP & HOME

RRSP - There are 2 RRSP accounts provided for you and your spouse to track your savings. Each account is given two stages to allow you to set different return rates reflecting your choice to go with a more aggressive portfolio followed by a more conservative porfolio during the last stages before your retirement. Enter your investment return rates, your age separating the 2 stages, your yearly contribution and the number of years you plan on constributing.

HOME - Your Home or properties can be tracked from present until the end of your retirement. Tracking during your pre-retirement period is broken down into 2 stages. This will afford you the flexibility to accurately track you property assets. Enter the estimated value of your home and the yearly increase in value if you currently own property and combine for more than one property. Select the age that defines the beginning of the second stage. This age could be when you purchase your first home or acquire additional investment properties. Enter an estimate of the yearly increase in value and the value of your new home or of your upgraded home plus any additional property you acquire. Leave blank if there is no change.

The values of your individual assets at retirement age is displayed below each asset. Your total current and retirement age asset is shown at right.

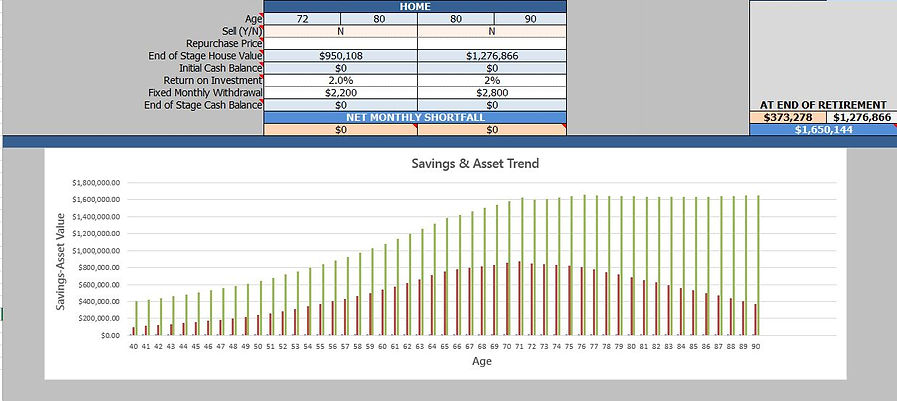

RRIF and HOME

This section covers your asset "drawdown" period between age 71 and end of retirement. Your RRSP accounts have been converted into RRIF (Registered Retirement Income Fund) accounts and your house is now available as a source of income should you need to access this asset.

RRIF - The Planner will automatically calculate and withdraw the minimum amounts required by law, but you may have to make additional withdrawal amounts to meet your needs. Use the Net Monthly Shortfall amounts to guide you. Shortfall amounts are net income amounts displayed in red for the corresponding stage and must be reduced to $0 by entering "gross" monthly withdrawal amount(s) that are approximately twice the displayed amount.

Note that Stage 2 starting age is fixed to your HOME Stage 2 age. This is to align your budgets with your withdrawals for each stage. Your remaining balance at the end of each stage is displayed.

HOME - Enter your present house value and set the annual appreciation % and the value at retirement is calculated and displayed.

Enter the age separating the 2 housing stages available to reflect the age you plan on changing you housing condition as it will tie-in your withdrawal amounts, both here and under your RRIF section with the budget you set based on your housing condition.

You also have the option of selling your house and repurchasing to help finance your retirement byt selecting Y (Yes) or N (No( from the dropdown list. If you select Y, you will have the option to repurchae (a smaller home) byt entering the house value (leave blank if you don;t re-purchase). Income from selling your home will be deposited in a savings account where you can set the return on investment %. Enter the amount you need to withdraw to meet your needs using the summary surplus/shortfall indicator.

Repeat for the 2nd stage. Balance at end of stage and remaining asset at end of retirement are displayed.

AVERAGE MONTHLY INCOME BREAKDOWN

This summary section display your gross monthly income amounts from all your income sources,your income tax and net income amount, your monthly budget and surplus or shortfall amount as well as your remaining asset for each and every year of your retirement.

The displayed amounts in your Surplus/Shortfall column os used to quide you on the amount you need to withdraw in the RRIF and HOME section. A negative RED amount indicate a shortfall and positive BLACK indicate a surplus. Try to enter a withdrawal amount in each stage to eliminate all shortfall (RED) without overdrawing too much. Overdrawing (surplus) amounts will be re-invested in your HOME/SAVINGS account.

How long your funds will last into retirement will be indicated by the age at which your asset is all gone and you are not able to eliminate the monthly shortfalls. Use this as a guide to start saving more while you still can and save as early as you can by going back to your asset section and contributing more. If necessarym you may have to reduce your budget amount or delay your retirement accordingly.

RETIREMENT PLANNER OVERVIEW

The above is an overall view of your retirement planner. From here you will enter all the required personal and financial information and make the necessary income withdrawal amounts during various stages of retirement to meet your budgeted needs. It is quite complex as it covers all your financial transactions during your retirement period. Don't be overwhelmed by the vast amount of information and take the time to read the instructions contained in the Planner as well as the basic information provided below to fully understand the logic and financial mechanics involved. In addition, there are many "comments" attached to each entry to help explain and guide you to making the entry and/or selection. Simply hover your mouse over the red triangles to access the dropdown comments.

Also, note that you only enter cells/boxes that are "white" and select from dropdown menu when cells are "pink". All "blue" cells/boxes cotain data that are generated automatically from your entry elsewhere.

BUDGET TEMPLATES

There are four Budget templates available covering the four potential housing conditions that may occur during your retirement. They are HOME (house), RENT, CONDO and RESIDENCE (retirement home). Noted that while these budgets are labelled by housing conditions, they are primarily used to reflect your changing income requirements during your retirement. For example, even if you plan on living in you house throughout, you can still use the other templates to reflect your changing spending requirements as you get older (less to not travel etc.) while you remain living in your home.

You should fill in the estimated budget amounts for all the applicable categories at present day $ value. The Planner will adjust the budget amounts based on the inflation rate you've set to the FUTURE value at your retirement age. If you've already calculated your monthly budget elsewhere, simply enter the overidding monthly amount at the top of each budget. You can also use the overriding feature to cut back in case you find that your assets do not meet your retirement planning.

The inflated amounts for the corresponding budget will be used to compare against your selected withdrawal amounts for the housing stages during your retirement. This will guide you to withdraw more, or less to meed you needs for each year of retirement.

FEDERAL AND PROVINCIAL TAX

Detail Federal and Provincial tax are calculated for each and every year of your retirement. While the intention is to be as precise as possible, certain aspects not representing significant amounts may have been ignored.

There are no user input required on these tabs.

ASSETS

This is an overview of your ASSETS Section and where you enter and track your RRSP, RRIF and HOME accounts and set the withdrawal amounts to satisfy your financial needs during retirement.

The column on the right gives you the total value of your liquid assets, The last balance shows your Total Asset at the end of your retirement which will include your home.

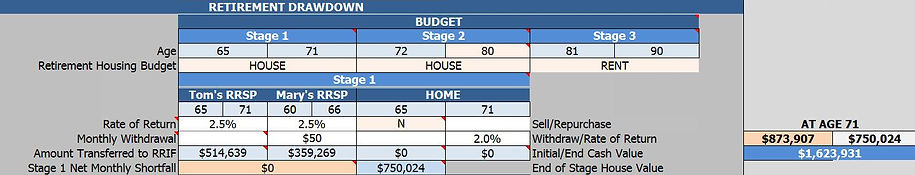

RETIREMENT DRAWDOWN - BUDGET & RETIREMENT STAGE RRSP

BUDGET - Set your retirement budgets for the 2 available stages by setting the age separating the stages and selecting from the dropdown list, the associated housing budget. Click on the BUDGET button to go to the bedget page where you will have access to the four budget templates - HOUSE, CONDO, RENT, and RESIDENCE. Fill out the two that suits your retirement planning.

Retirement Stage RRSP - This is an extension of your RRSP to cover the period from the start of your retirement until you reach 71 year of age where your RRSP accounts will be converted into RRIF accounts. Unlike the pre-retirement stage accounts, you can now withdraw for your retirement needs and no contribultion is possible. A net monthly shorfall indicator showing the largest shortfall amount for this stage. Use it to enter the withdrawal amounts from your RRSP accounts. Your withdrawal amounts are "gross" income so please enter amounts that total to twice the net amount and adjust reduce the shortfall to $0 or a low negative amount. Try not to overdraw even though any over drawn amount will be re-invested in your savings account.

ERRORS AND WARNINGS

Warnings:

Income withdrawal cells will be highlighted RED to indicate that you've exceeded your available funds . The amount you've entered will be ignored and the maximum available amount will be assumed but it's is better to reduce the amount until the highlight goes away so your Planner can show the accurate withdrawal information.

Clarifications:

Most cells are taged with dropdown notes to help you understand what it is you are entering and/or what the information represents. Simply hover over the red markings or corners of the cell. If there is a message, it will be displayed.

Errors:

Beacause the Planner allows you to set many stages to reflect your savings strategy and income needs, the age you set that are tied to these stages must be set in a logical sequence. With the incorporated dropdown list, it is not possible to enter an out-of-sequence or illogical age. However, if you change your retirement age after you've selected all the subsequent ages, it is possible that the new age you select will result in an inconsistant sequence. When this happens, the Planner may fail showing #N/A, and/or the cells for certain age selection wil be highlighted RED. Simply re-select your age entry for all highlighted cells from the revised dropdown list and the error will be corrected.